A Year in Review: Why My Qantas Points Strategy Shifted This Membership Year

This isn’t a points total recap. It’s a look at how my Qantas Points strategy shifted this membership year — away from promo-driven spending and toward a calmer, more repeatable system built around everyday spend.

Most “year in review” posts focus on totals.

Big numbers. Screenshots. Highlights.

This one doesn’t.

Qantas measures behaviour by membership year, not calendar year — and with one month still to go, this isn’t about final outcomes. Instead, it’s about something more useful: how my strategy shifted, and why.

The biggest change this membership year wasn’t earning more points.

It was getting clearer on what should count as everyday spend — and building a system that reflects real life, not just promotions.

When points stop reflecting life, the system breaks

One of the easiest traps in points collecting is letting the earning mechanism dictate spending.

That’s when:

You buy things earlier than you need.

You buy more than you otherwise would.

Points stop being a by-product of life and start driving behaviour.

Over time, that creates friction. It also makes the system fragile — because it only works if you keep forcing decisions.

This membership year, I deliberately stepped back from that.

Why I reduced reliance on Qantas Wine

Wine has historically been a strong points earner for me — and it still can be.

But it’s not a significant part of my everyday lifestyle.

That meant any meaningful volume of wine-related points was coming from:

buying ahead of need;

buying more than I’d otherwise consume (and doing a lot of cellaring); and

spending because of points, not because of life.

This year, I reduced that reliance.

Not because wine offers are bad — they’re often excellent — but because earning points should reflect what you already spend, not what you can be encouraged to buy.

Stepping back from wine made the system:

less capital-intensive;

less promo-dependent; and

more honest.

And, importantly, more sustainable.

Dialling up gift cards — deliberately and precisely

At the same time, I deliberately dialled up gift card usage.

Not as a shortcut.

Not to inflate numbers.

But as a precision tool.

Gift cards weren’t about spending more — they were about extracting more value from spend that was already happening.

Used properly, they:

route everyday purchases through higher-earning channels;

allow stacking without changing behaviour; and

turn neutral spend into strategic spend.

This wasn’t blanket buying or speculative stockpiling. It was:

specific retailers;

clear use cases; and

purchased when the numbers made sense.

That distinction matters. Gift cards are powerful because they amplify existing spend — not because they create new spend.

Insurance: timing matters, but it’s not repeatable

Insurance played a role this year, but it’s worth being clear about how.

The points earned here came from timing a policy review to coincide with a promotion. That’s not something you repeat every year, and it’s not something you should force.

Insurance decisions should always be driven by:

coverage;

cost; and

suitability.

Points are secondary.

That said, if you’re already reviewing a policy, aligning timing with a strong Qantas offer can deliver outsized value. It’s not a core system — it’s a lever you pull when the timing is right.

What didn’t change: cards, structure, restraint

One of the quieter shifts this year was actually not changing much.

My card setup remained largely the same. My Qantas Titanium credit card is the workhorse of the points-earning system and changing it for another card wouldn’t make sense at this point.

There was no constant churn.

No weekly adjustments and time-consuming planning.

Once a structure is right, the goal isn’t activity — it’s consistency.

Letting systems run without interference is often the most underrated skill in points earning.

How the earning mix changed

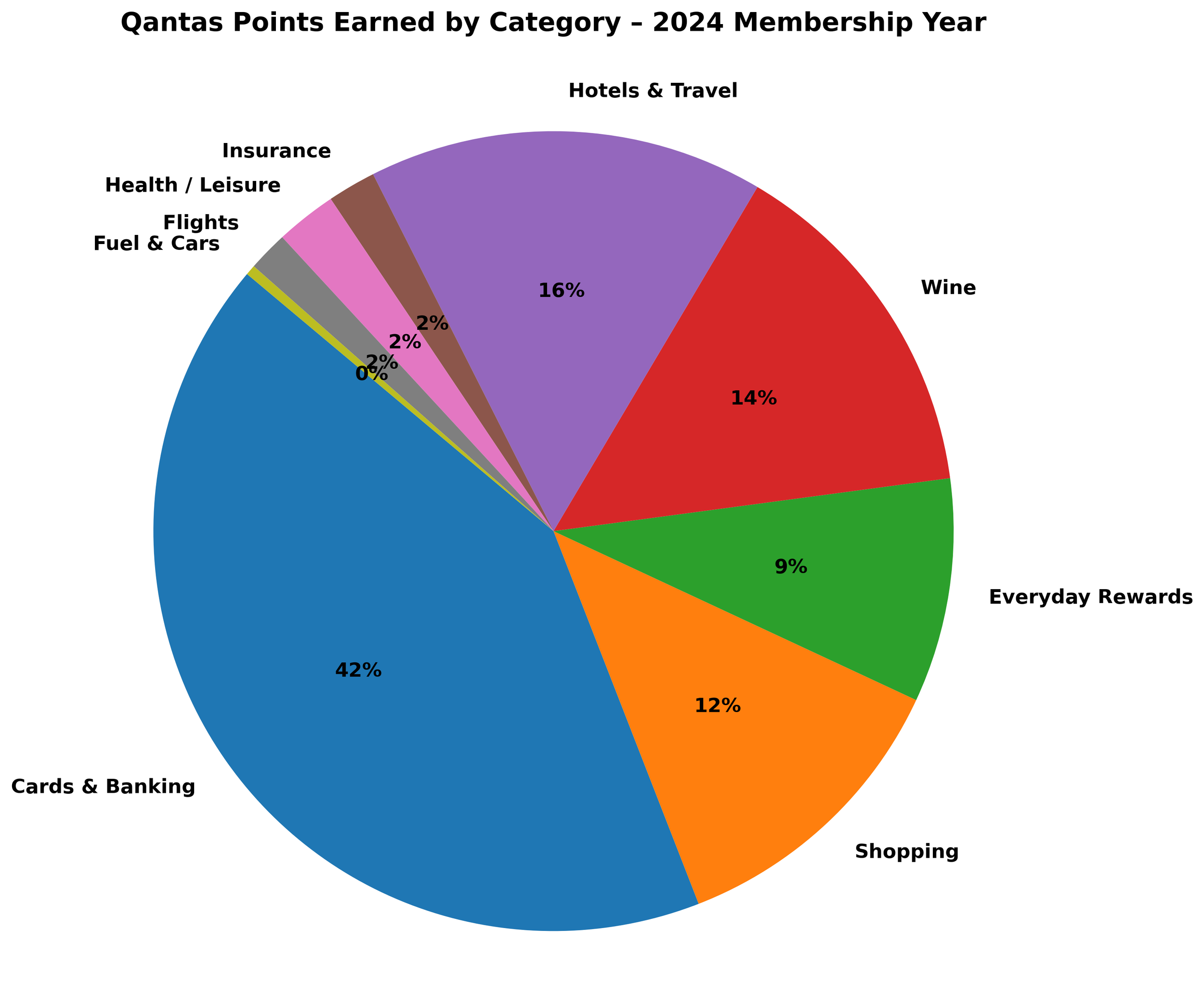

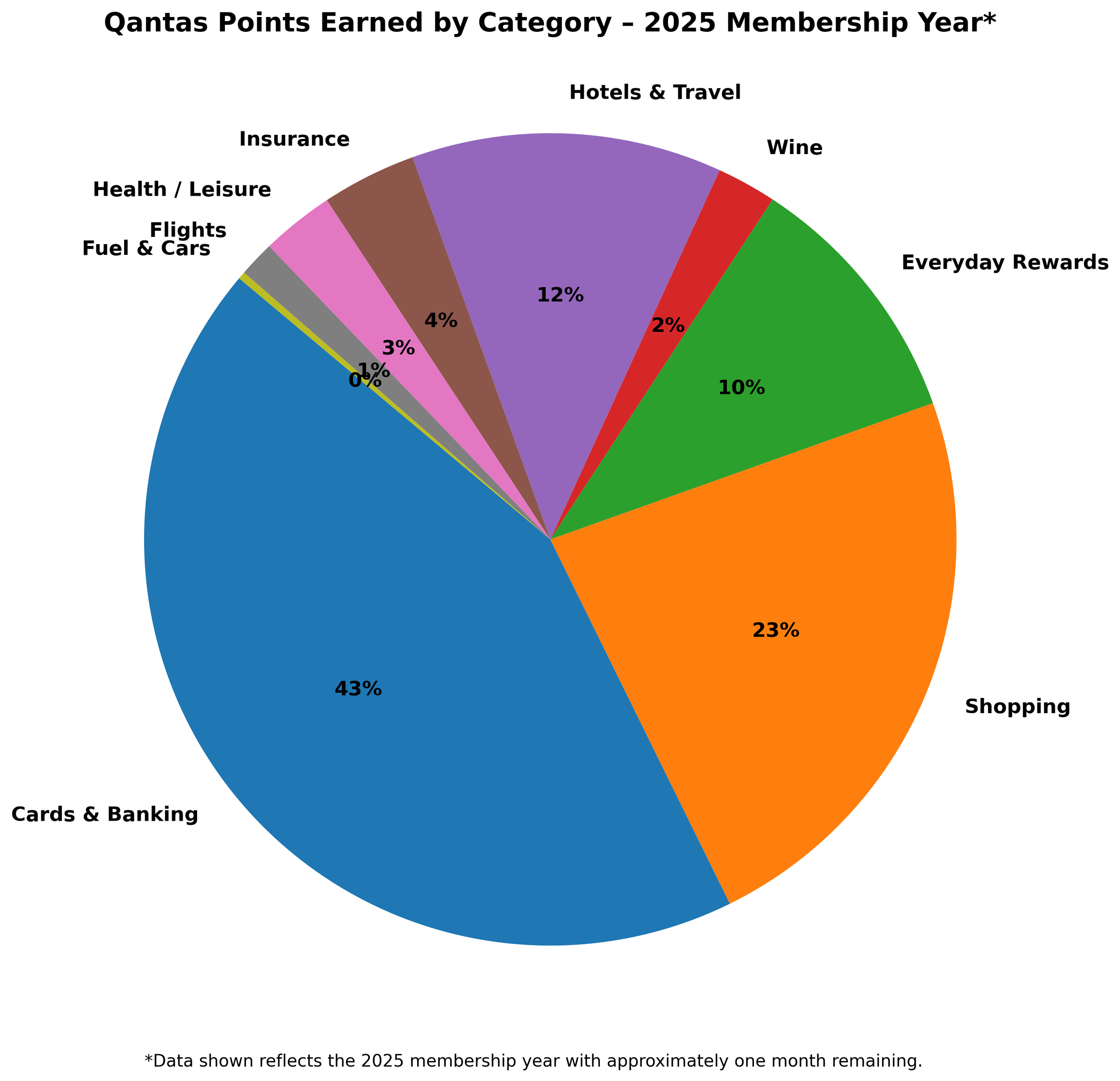

Looking at where points come from — not just how many — tells a much clearer story about strategy.

It highlights whether points are being earned from everyday behaviour, or from discretionary spending driven by promotions.

2024 Membership Year

A meaningful share of points came from categories that were not part of my everyday lifestyle, contributing to a more episodic and promo-driven earning profile.

2025 Membership Year

The profile shifted toward genuinely repeatable earning — Everyday Rewards and shopping-led spend — with reduced reliance on non-everyday categories.

Reducing pressure on a single account

Another important shift this year was adding Qantas Business Rewards as a parallel earn stream.

This didn’t inflate my personal Qantas Frequent Flyer results — but it did reduce the pressure to force outcomes into one account.

Separating business-linked earning from personal lifestyle earning made the system calmer and more accurate. Each account now reflects what it’s meant to reflect.

The real outcome: fewer decisions, less noise

The biggest change this membership year wasn’t numerical.

It was psychological.

fewer “should I?” moments;

less urgency around every promotion; and

more confidence letting good offers pass.

The system became quieter — and that’s usually a sign it’s working.

What comes next

At the end of my membership year, I’ll publish a clean, side-by-side comparison — measured the way Qantas actually tracks behaviour.

Not to prove anything.

But to show what happens when points strategies align with real life instead of competing with it.

For now, this review isn’t about totals.

It’s about building a system you don’t have to fight.